More Solutions

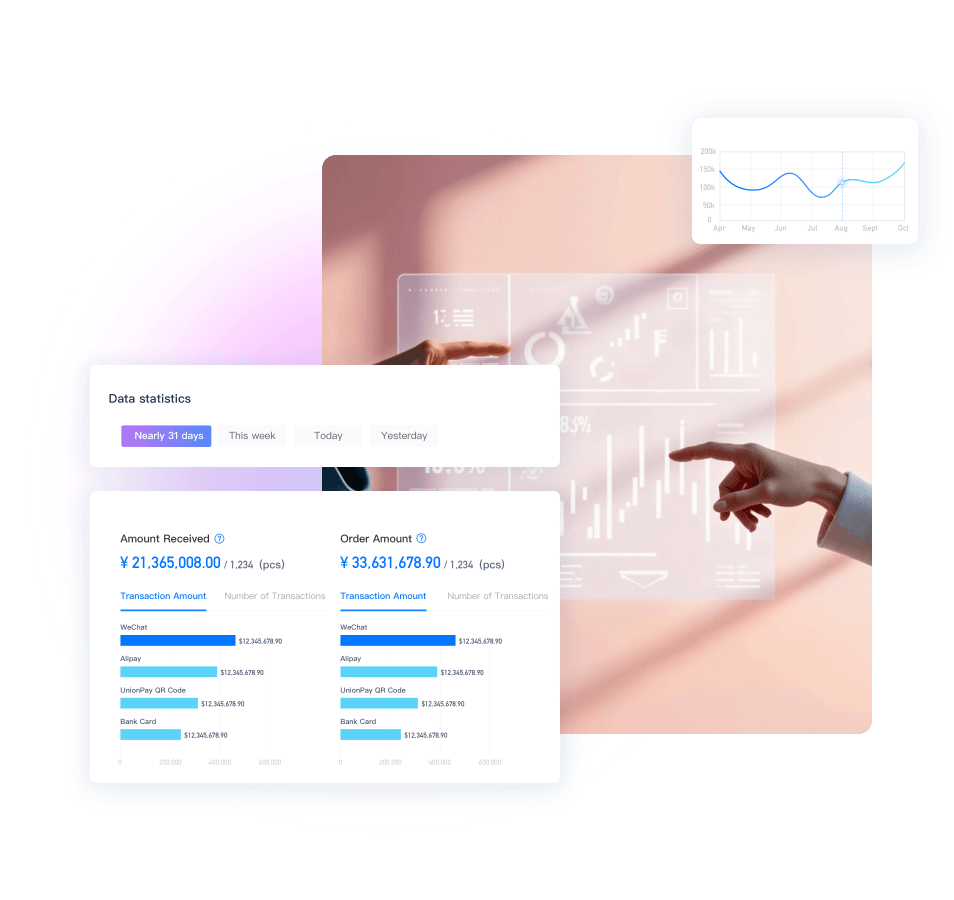

Brands, chains, e-commerce platforms, or SaaS, cross-border, meta-universe companies can find

exclusive payment solutions

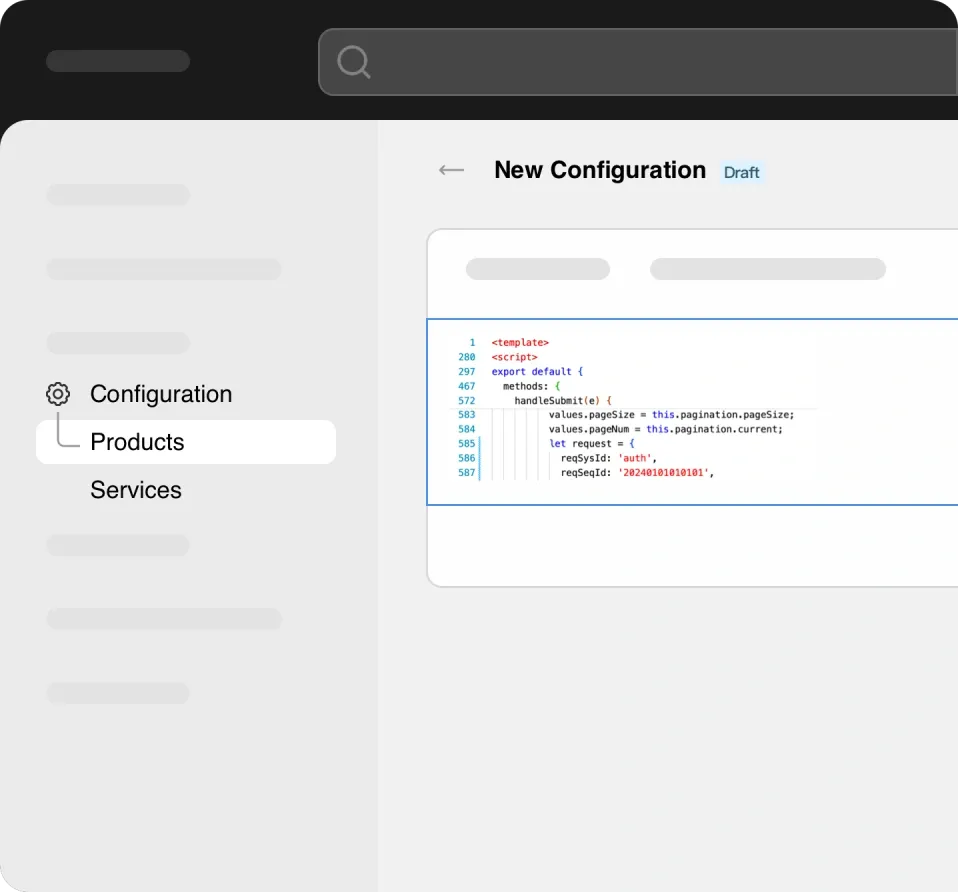

Industry

100

+

Industrial customers

10000

+

SME

10M

+